The Ultimate Starter’s Guide to Setting Up an Offshore Trust

Find out How an Offshore Trust Can Enhance Your Estate Planning Strategy

If you're looking to enhance your estate preparation approach, an overseas Trust might be the option you need. These trusts use one-of-a-kind benefits that can guard your assets while offering tax and personal privacy advantages. Several individuals have misconceptions about how they function and their importance. Recognizing these components can be crucial for your economic future. Allow's explore what an offshore Trust can do for you.

Comprehending Offshore Counts On: What They Are and How They Function

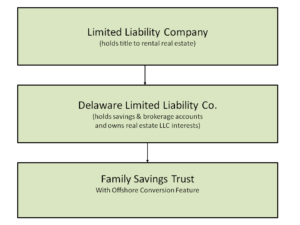

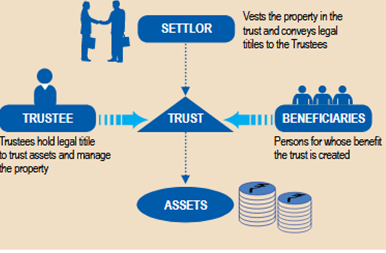

Offshore trust funds are effective financial devices that can aid you manage your assets while providing advantages like privacy and tax benefits. Generally, an offshore Trust is a legal arrangement where you move your possessions to a count on developed in an international jurisdiction. This arrangement enables you to separate possession from control, implying you don't directly possess the assets any longer; the Trust does.

You'll appoint a trustee to take care of the Trust, guaranteeing your possessions are taken care of according to your desires. This arrangement usually secures your assets from financial institutions and legal cases, as they're held in a various legal system. Furthermore, you can specify exactly how and when recipients get their inheritance, including a layer of control to your estate planning. By recognizing how overseas trusts function, you can make enlightened decisions that straighten with your financial objectives and provide peace of mind for your family's future.

Secret Advantages of Offshore Trusts for Possession Defense

While you might not always be able to anticipate economic obstacles, establishing an offshore Trust can be a positive action towards safeguarding your possessions. One vital benefit is the added layer of safety and security it supplies versus financial institutions and legal judgments. By placing your assets in an offshore Trust, you produce a barrier that makes it harder for prospective complaintants to reach your wide range.

In addition, overseas trust funds can help you safeguard your assets from economic or political instability in your home nation. This geographical separation guarantees that your riches stays protected, even if your domestic situation changes unexpectedly.

Another advantage is the potential for privacy. Several overseas territories enable for higher privacy, making it challenging for others to discover your financial holdings. This discretion can hinder unimportant claims and undesirable interest. Overall, an overseas Trust can be a powerful tool in your property defense method, giving you peace of mind.

Tax Obligation Advantages of Developing an Offshore Trust

When you establish an overseas Trust, you not just improve your asset defense however also disclose important tax obligation deferral chances. This can considerably reduce your gross income and help your wide range grow with time. Comprehending these advantages can be a game-changer in your estate preparation strategy.

Property Protection Conveniences

Establishing an overseas Trust can greatly improve your asset security approach, particularly if you're looking to protect your wealth from lenders and lawful judgments. By placing your properties in a trust, you successfully separate them from your personal estate, making it harder for financial institutions to access them. This added layer of security can hinder suits and supply satisfaction.

Additionally, several offshore jurisdictions have durable personal privacy laws, ensuring your monetary events remain private. In case of lawful disagreements, having possessions kept in an overseas Trust can complicate attempts to take those possessions, as it's even more tough for creditors to navigate foreign legislations. Ultimately, an overseas Trust is an effective device in securing your wide range for future generations.

Tax Deferment Opportunities

Offshore depends on not only use robust possession defense yet likewise present significant tax obligation deferral chances. By placing your possessions in an offshore Trust, you can potentially defer taxes on revenue and funding gains until you take out those funds. This technique allows your financial investments to expand without prompt tax obligation liabilities, optimizing your riches with time.

Furthermore, relying on the jurisdiction, you might take advantage of reduced tax obligation rates or also no taxes on certain sorts of revenue. This can supply you with a more positive atmosphere for your financial investments. Making use of an offshore Trust can boost your overall estate planning method, allowing you to manage your tax obligation direct exposure while securing your properties for future generations.

Enhancing Personal Privacy and Discretion With Offshore Trusts

While several individuals look for ways to secure their properties, making use of offshore depends on can greatly improve your privacy and discretion. By positioning your assets in an offshore Trust, you produce a layer of protection against potential click here for more financial institutions, claims, and public analysis. This framework commonly assures that your individual details stays exclusive, as overseas jurisdictions usually offer strict confidentiality regulations.

Moreover, the assets held in the Trust are not publicly disclosed, allowing you to manage your wealth inconspicuously. You can also control exactly how and when beneficiaries access their inheritances, further shielding your purposes from prying eyes.

In addition, the complicated lawful frameworks of overseas depends on can deter those trying to test or access your possessions (offshore trust). Ultimately, choosing an offshore Trust empowers you to protect your financial personal privacy, offering satisfaction as you navigate your estate planning trip

Preparation for Future Generations: Wealth Transfer Techniques

As you think about the privacy advantages of overseas counts on, it's equally essential to consider how to efficiently pass on your riches to future generations. Offshore depends on can act as effective devices for wide range transfer, enabling you to determine how and when your properties are distributed. By developing an overseas Trust, you can establish details terms to assure that your heirs receive their inheritance under problems that straighten with your values.

Additionally, overseas depends on typically provide tax obligation advantages, which can help maintain your riches for future generations. You can structure the Trust to secure your assets from financial institutions or legal claims, assuring that your loved ones profit from your difficult job.

Typical Misunderstandings Concerning Offshore Counts On

What do you really understand about overseas trust funds? Numerous individuals think they're just for the ultra-wealthy or those trying to conceal assets. Actually, overseas counts on can be legitimate tools for you could look here estate preparation and asset security for a wider audience. Another common misconception is that they're constantly illegal or dishonest. While it holds true that some misuse them for tax obligation evasion, a properly established overseas Trust adheres to legal criteria and can offer considerable advantages. You might also think that establishing one up is overly complicated or expensive. While there are factors to consider, many find that the advantages surpass the first investment. Lastly, some concern blowing up over their properties. However, with the best framework and trustees, you can keep a degree of oversight and adaptability. By comprehending these false impressions, you can make informed decisions about whether an offshore Trust fits your estate planning strategy.

Steps to Establishing an Offshore Trust as Component of Your Estate Plan

Picking a Jurisdiction

Picking the right jurisdiction for your overseas Trust is essential, as it can considerably influence the effectiveness of your estate plan. Begin by looking into countries with beneficial Trust legislations, tax obligation benefits, and strong possession defense. Furthermore, assume about the costs connected with setting up and maintaining the Trust in that jurisdiction, as fees can differ substantially.

Selecting a Trustee

How do you guarantee your offshore Trust operates smoothly and effectively? Consider experts like lawyers or monetary consultants that specialize in overseas depends on.

You need to additionally evaluate their communication design-- ensure they're responsive and clear. Examine their charges upfront to prevent surprises later. It's wise to assess their track document with various other clients. A solid track record can offer you self-confidence that your Trust will be taken care of efficiently, straightening with your estate preparing goals. Pick carefully, and your overseas Trust can prosper.

Financing the Trust

Once you have actually chosen the ideal trustee for your overseas Trust, the following step is funding it efficiently. You'll want to move possessions right into the Trust to ensure it accomplishes your estate intending goals.

Bear in mind the tax effects and the policies of the overseas jurisdiction. Make specific to document each transfer appropriately to preserve transparency and abide with lawful needs. When moneyed, your overseas Trust can provide the advantages you look for, such as property security and tax effectiveness, enhancing your general estate preparation approach.

Often Asked Questions

What Is the Distinction In Between an Offshore Trust and a Domestic Trust?

An offshore Trust's assets are held outside your home country, supplying privacy and possible tax advantages. On the other hand, a residential Trust operates within your nation's legislations, commonly lacking the same level of property defense and discretion.

Can I Manage My Offshore Trust Possessions Straight?

You can not manage your offshore Trust assets directly due to legal constraints. Instead, a trustee oversees those properties, ensuring conformity with guidelines and shielding your passions while you gain from the Trust's benefits.

Are Offshore Trusts Legal in My Country?

Yes, overseas trust funds are legal in numerous countries, but guidelines differ. You'll need to investigate your country's legislations or consult a lawful expert to guarantee conformity and comprehend any kind of tax implications entailed.

Just how much Does It Cost to Set up an Offshore Trust?

Establishing an overseas Trust usually costs in between $5,000 and $20,000, relying on the intricacy and jurisdiction. You'll wish to consult with a lawful expert to obtain an exact price quote for your details needs.

If I Relocate Nations?, what Takes place to My Offshore Trust.

If you relocate countries, your overseas Trust's tax ramifications and legal standing may change. You'll require to consult professionals in both territories to assure compliance and make necessary adjustments to keep its defenses and advantages.

Verdict

Integrating an offshore Trust into your estate preparation can be a game-changer. It not just guards your possessions from possible risks but also provides tax benefits and improves your personal privacy. By preparing for future generations, you'll guarantee your riches is maintained and passed on according to your desires. Do not allow mistaken beliefs hold you back; with the best guidance, you can establish an overseas Trust that genuinely safeguards your tradition. Beginning exploring your alternatives today!

Basically, an overseas Trust is a lawful arrangement where you transfer your properties to a count on established in an international territory. In the occasion of legal conflicts, having possessions held in an offshore Trust can complicate efforts to confiscate those properties, as it's even more challenging for lenders to browse international laws. Making use of an offshore Trust can improve your overall estate planning method, allowing you to regulate your tax obligation exposure while securing your properties for future generations.

As soon as funded, your overseas Trust can offer the benefits you seek, such as asset protection and tax performance, boosting your general estate preparation strategy.

What Is the Distinction In Between an Offshore Trust and a Domestic Trust?